CAG in collaboration with Solar Advisory Unit - Thiruvarur, organised a stakeholder meeting on the adoption of rooftop solar energy under the PM Surya Ghar Yojana which was held on 24th September 2025 at Hotel Kasi’s Inn, Thiruvarur. The main objective of this meeting was to raise awareness among consumers about solar energy, including subsidy schemes, loan options, and the procedures for installation. The meeting had participants from solar developers, financial institutions, Tamil Nadu Power Distribution Company Limited officials, and media representatives.

Participants with CAG’s brochure on solar rooftop solar systems

Mr.R.Ramesh, Coordinator, Solar Advisor Unit - Thiruvarur, welcomed the participants and emphasised that solar power has become well-known as one of the most sustainable and reliable renewable energy sources.

Mr. R.Ramesh, Coordinator, Solar Advisor Unit - Thiruvarur, during the meeting

Mr.Bharath Ram, Senior Researcher, CAG presented an overview of CAG’s work and its current initiatives, with a focus on raising awareness about solar energy. He shared practical insights for consumers on what they need to know before installing a rooftop solar system, how to select vendors, grievance redressal procedures with vendors, and how to address concerns with DISCOM officials.

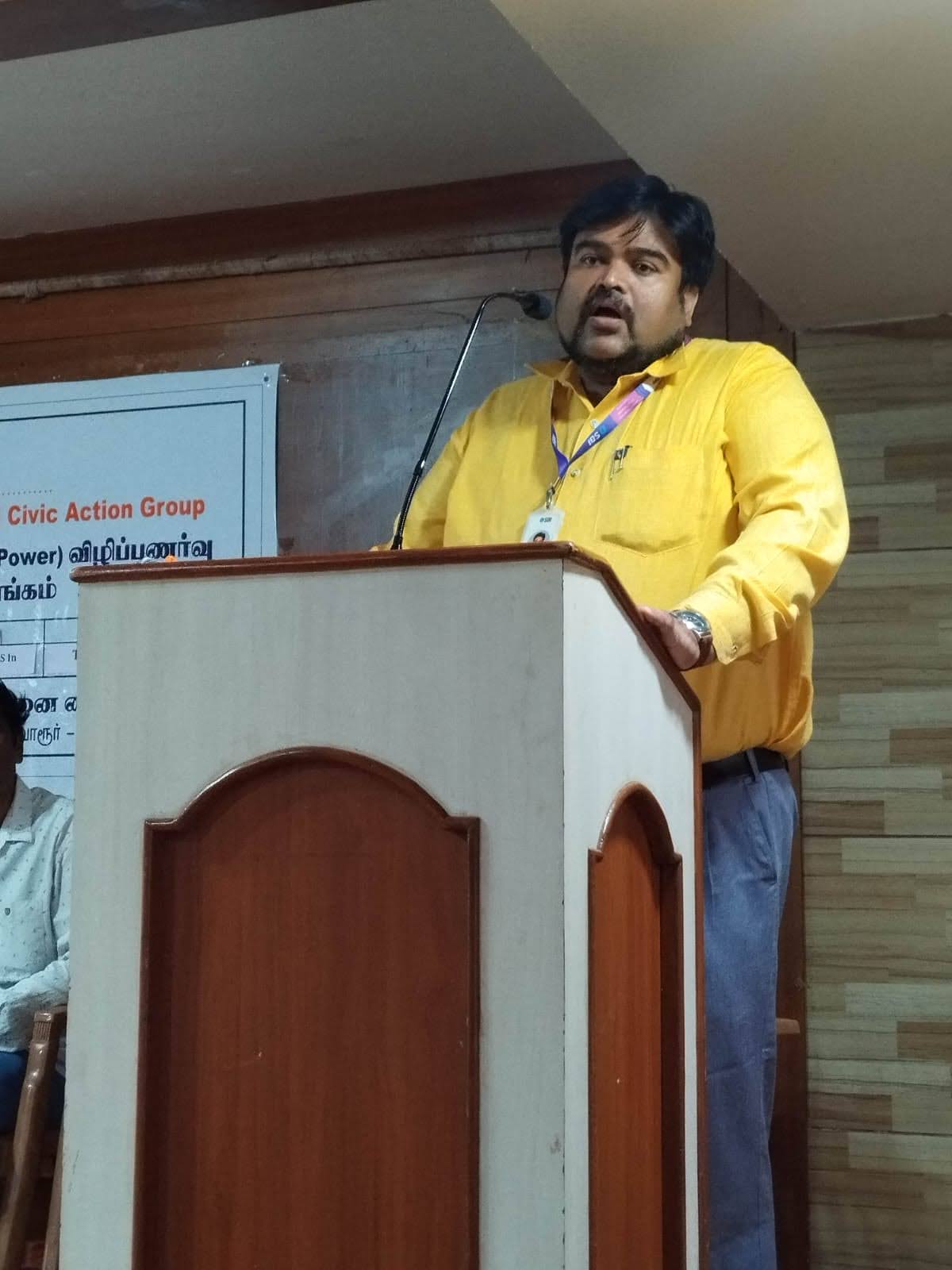

Mr. Bharath Ram, Senior Researcher, during the meeting

Mr. Rajavel, Solar Expert, Solar Advisory Unit - Thiruvarur, elaborated on the Central and State Government Subsidy Framework:

- The Central Government provides a subsidy of up to ₹78,000 for systems between 1–3 kW under the PM Surya Ghar Bijli Yojana.

- Applications must be submitted via the TNPDCL portal.

- Installation must be done only through MNRE-approved vendors.

- After site inspection and net-metering approval, the subsidy amount is directly transferred to the beneficiary’s bank account.

He further clarified that investment returns are realised within 5–6 years, followed by 20–25 years of free or low-cost power, contributing to both economic savings and environmental protection.

Mr. Rajavel, Solar Expert, during the meeting

Mr. Sahayaraj, Deputy Manager, State Bank of India, explained that banks provide solar installation loans at concessional interest rates ranging from 6% to 10% with repayment terms of 5 to 10 years.

- Loans cover up to 70% of the total project cost.

- Small-scale installations do not require collateral.

- Large-scale projects may require property mortgage.

- Creditworthiness is assessed through the CIBIL score.

He also added that the PM Surya Ghar Bijli Yojana (Government of India) and Tamil Nadu Solar Energy Policy 2023 have been integrated with banking channels for faster sanction and disbursement.

Bank representatives, during the meeting

Mr. Palaniyappan, Assistant Executive Engineer, Mr. Muruganandam, Assistant Engineer and Mr. Kumar, Assistant Engineer, TNPDCL actively participated and shared guidance on safety standards and grid connectivity during the solar installation.

Mr. Muruganandam, Assistant Engineer, TNPDCL during the meeting

The meeting proved to be an excellent platform for consumers, financial institutions, and technical experts to engage in a meaningful discussion about solar energy adoption in Tamil Nadu. Representatives from nationalised banks, solar developers, and consumer organisations also had the opportunity to interact with participants, addressing their questions on finance, maintenance, and grid networks.